Samsung's Historic Surge: Electronics Giant Nears $900 Billion Valuation Driven by HBM4 AI Chips

Samsung Electronics is currently witnessing one of the most remarkable financial turnarounds in the modern tech industry. After facing significant headwinds just a year ago, the South Korean conglomerate has successfully pivoted its strategy, capitalizing on the global demand for high-performance computing and strategic manufacturing partnerships. This resurgence is not just a recovery but a record-breaking sprint toward a milestone that was once considered unreachable for the company.

- ✨ Samsung's market valuation has reached a staggering $876.24 billion, nearing the historic $900 billion mark.

- ✨ The company's stock has seen a 358% increase compared to its valuation of $244.51 billion just one year ago.

- ✨ Strategic deals, including a $16.5 billion semiconductor contract with Tesla, have fueled investor confidence.

- ✨ Samsung is now the world leader in mass-producing HBM4 chips, essential for next-generation AI accelerators.

- ✨ Analysts predict a potential move towards a $1 trillion valuation as the memory chip shortage persists.

The momentum for Samsung Electronics has been building steadily over the past several months. While the technology giant faced hurdles in early 2025, the tide turned decisively after it secured a landmark $16.5 billion deal to manufacture specialized semiconductor chips for Tesla. This partnership underscored Samsung's technical prowess in the foundry business and set the stage for a valuation that is now knocking on the door of $900 billion for the first time in history. Financial experts are even beginning to discuss the possibility of the company joining the exclusive $1 trillion club in the near future.

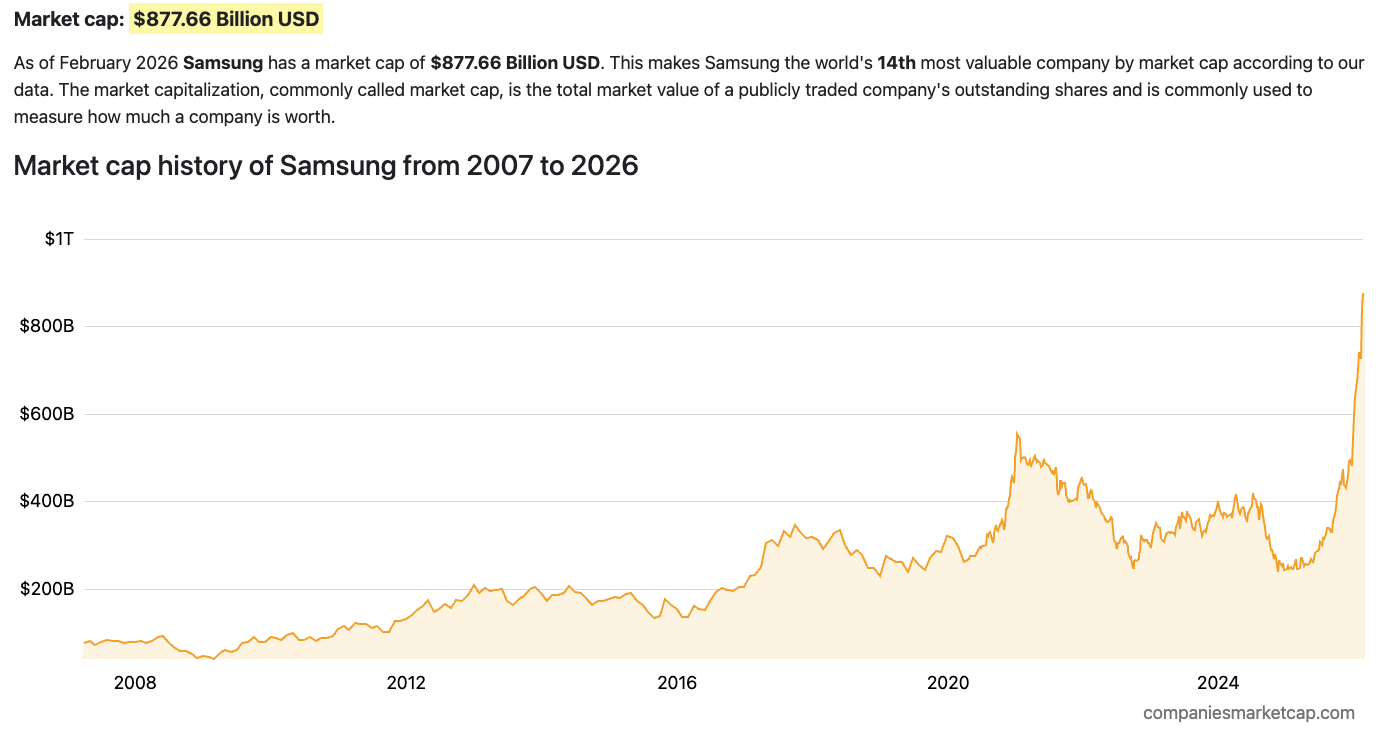

The Meteoric Rise of Samsung’s Market Capitalization

Currently, Samsung Electronics’ market valuation is hovering at approximately $876.24 billion. To put this in perspective, this represents a massive 358% surge from the $244.51 billion valuation recorded only twelve months ago. The company’s share price recently breached the $130 threshold, a clear indicator of robust market sentiment. This rapid appreciation is largely attributed to reports indicating that Samsung intends to price its cutting-edge HBM4 chips at $700 per unit—a 30% price hike that reflects the premium nature of its latest hardware.

Samsung finds itself in an elite group of manufacturers. Alongside SK Hynix and Micron, it is one of the only firms globally capable of producing high-bandwidth memory chips like HBM3, HBM3E, and the new HBM4. These components are the lifeblood of AI technology and accelerators used by industry titans such as Amazon, Google (Alphabet), Meta, and Microsoft to power their massive data centers and generative AI models.

Dominating the AI Hardware Supply Chain

Setting a new industry benchmark, Samsung recently became the first manufacturer to initiate mass production of HBM4 chips. Industry insiders suggest that a significant portion of this initial supply is destined for Nvidia, which currently holds the title of the world's most valuable company. Samsung’s HBM4 and SOCAMM2 modules are expected to be integrated into Nvidia’s upcoming "Vera Rubin" platform. Set for a late-year launch, the Vera Rubin architecture is anticipated to be the most powerful AI chip ever created, further cementing Samsung's role as a critical supplier

The long-term outlook remains incredibly positive for the South Korean giant. With analysts forecasting that the global memory chip shortage will persist well into 2027, Samsung is perfectly positioned to capture sustained revenue and profit growth. As the industry moves toward more complex AI applications, Samsung’s HBM4 chips are already being recognized for delivering market-leading performance and energy efficiency, ensuring the company remains at the forefront of the silicon revolution.

What is the current market value of Samsung Electronics?

As of February 2026, Samsung Electronics has reached a valuation of approximately $876.24 billion, which is a record high for the company and nears the $900 billion milestone.

How much has Samsung's valuation grown in the last year?

The company has experienced a meteoric 358% increase in valuation, rising from just $244.51 billion one year ago to nearly $900 billion today.

What specific products are driving this financial growth?

The primary drivers are Samsung's advanced semiconductor chips, specifically the HBM4 (High Bandwidth Memory) chips used in AI accelerators, as well as high-profile manufacturing deals with companies like Tesla and Nvidia.

Why are HBM4 chips so important for the tech industry?

HBM4 chips are critical components for Artificial Intelligence (AI) platforms. They provide the high-speed memory required for massive data processing in AI accelerators used by global giants like Google, Amazon, and Microsoft.

Is Samsung expected to reach a $1 trillion valuation?

Given the ongoing global memory chip shortage and Samsung's leadership in the HBM4 market, many financial analysts believe the company is on a clear path toward the $1 trillion mark.

🔎 In conclusion, Samsung Electronics has successfully navigated a period of uncertainty to emerge as a dominant force in the AI-driven hardware era. By securing strategic foundry contracts and leading the charge in high-bandwidth memory production, the company has not only salvaged its valuation but has set a new standard for growth in the semiconductor industry. As the demand for AI processing power continues to outpace supply, Samsung’s trajectory toward a trillion-dollar valuation seems more like an inevitability than a mere possibility.

Post a Comment